Get Free Tax Preparation Help

The University of Illinois’ VITA program offers FREE tax assistance to low- to moderate-income (gross income less than $67,000), older adults (over age 60), limited English speaking taxpayers, and persons with disabilities. It is our privilege to help residents in need prepare their tax returns.

The VITA Program begins early in February. We will accept new tax returns for preparation until Saturday, April 5. Taxpayers must return to Salt & Light in Urbana by April 12 to review and sign their completed returns.

Check the VITA blog for updates on dates and times the VITA program is open

Get Free Tax Preparation Help

To participate in the VITA program, please bring identification and tax documents to Salt & Light (1819 Philo Road, Urbana). Without these documents, your tax return cannot be prepared.

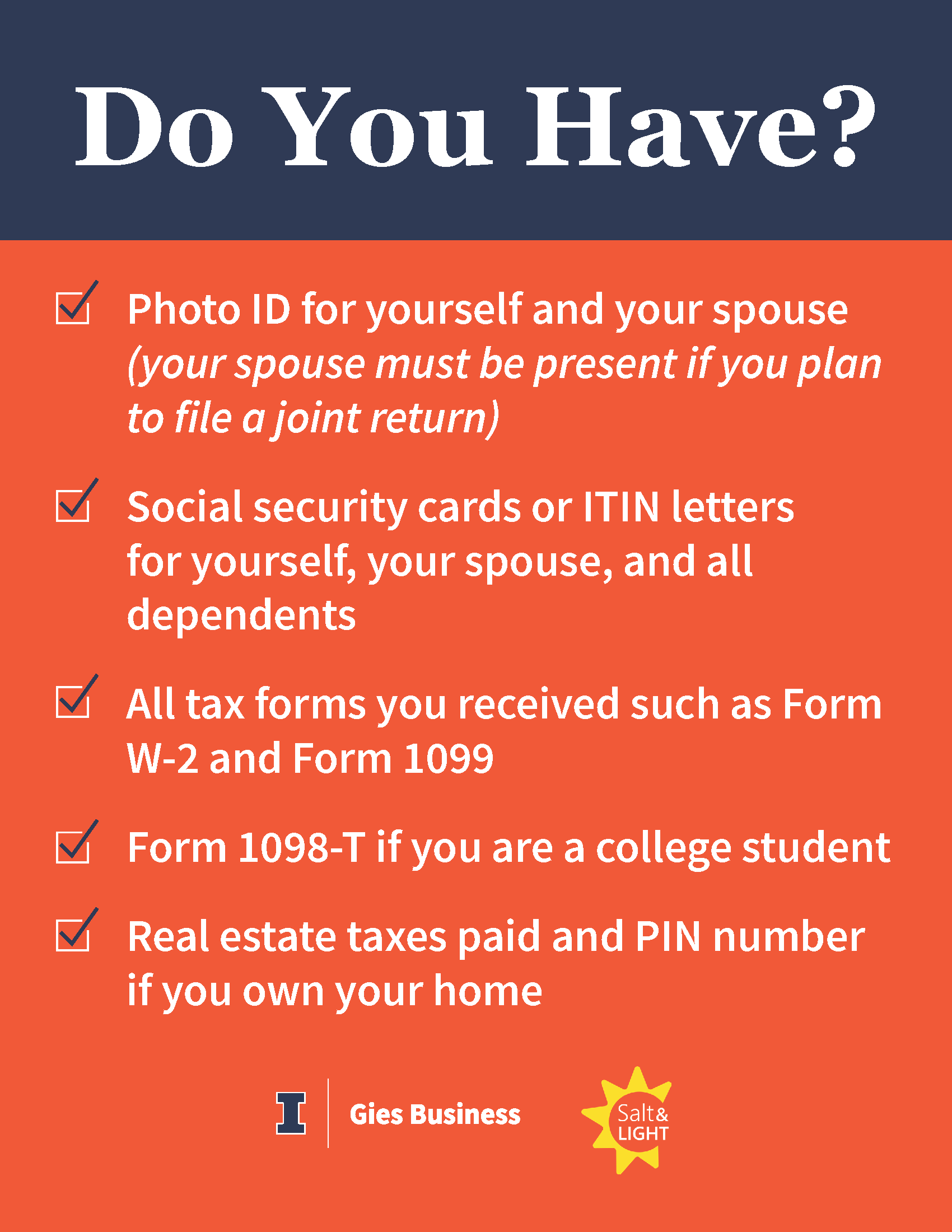

You will need to bring:

- Photo ID for yourself and your spouse. (Your spouse must be present if you plan to file a joint return.

- Social security cards or ITIN letters for yourself, your spouse, and all dependents (for example, your children).

- All tax forms you received such as Form W-2 and Form 1099.

- Form 1098-T (if you are a college student).

- Real estate taxes paid and PIN if you own your home.

- Bank routing and account number (if you'd like direct deposit of your refund).

VITA Process

Step 1: Initial Visit

During this visit, a trained volunteer will review your financial documents, verify your identity as required by the VITA program, and scan relevant tax documents to a secure Box folder. You will be asked to complete an intake/interview form so that your tax return can be prepared.

Step 2: Tax Return Prepared

Students from the Gies Department of Accountancy will prepare your tax return. Students are trained through the IRS VITA program and supported by Gies faculty.

You will receive a telephone call if there are questions about your tax return, and when your tax return is ready for your review. Typically, tax returns are completed in 2-3 weeks.

Step 3: Return to Salt & Light in Urbana

During this visit, you will review your tax return, ask any questions, and sign documents authorizing the VITA team to file your returns electronically. Your tax return cannot be filed until you return for this visit.

Bring your government-issued photo identification to this visit. All taxpayers listed on the tax return must be present to sign the tax return.

Frequently Asked Questions

The VITA program prepares current year returns, some prior year returns, and amended returns.

Will MTD take me there?

Bus routes to Salt & Light:

- During daytime hours: The 2 Red serves the Salt & Light stop at Philo & Colorado. The 50 Green also goes there on Saturdays

- During evening hours: The 50 Green serves the Salt & Light stop at Philo & Colorado.*For accurate route maps and time details, visit mtd.org.

When does the VITA program begin?

Beginning early in February, you may bring your tax materials for the initial meeting to Salt & Light in Urbana. No appointment is needed, and drop offs are taken on a first-come first-served basis until we are full. See the VITA blog for updated hours.

What do I need to bring?

- Every taxpayer and their spouse must come to Salt & Light in Urbana to drop off and pick up their documents. Both must bring a photo ID.

- Social security cards (or ITIN letters) for the taxpayer, spouse, and all dependents

- All tax documents such as Form W-2 and Form 1099

- Form 1098-T for all college students

- Real estate taxes paid and PIN if you own your home.

- Bank routing and account number (if you would like direct deposit of your refund)

How long will it take to get my return completed?

Tax returns will be prepared on a first-come, first-served basis. An estimated length of time for completion of the return can be given at the time of intake. This will be an estimate, and actual time to completion of the tax return could vary based on many factors.

Is my information secure?

We have developed a secure transmission and temporary storage system for all taxpayer-related documents. Your original documents will be returned to you after they are scanned. You will not leave any original documents with us. Once your tax return has been prepared and submitted to the taxing authorities, all virtual copies of the documents will be permanently deleted from our system.

What happens after my initial visit?

You may receive a phone call from a student if more information is needed. If the tax preparation team leaves you a phone message with a question, please call back. Call (217) 300-4784) - NOT the number shown on your caller ID.

You also will receive a telephone call when your return is ready to be reviewed and signed by you.

When your tax return is finished, you must return to Salt and Light to review your tax return and sign authorizations for the VITA program to transmit your tax return to the IRS.

Please note, your tax return will not be filed until:

- You sign forms, at Salt & Light, authorizing us to submit your return electronically.

- You mail the tax return. Sometimes, tax returns cannot be filed electronically. If so, then you will be given instructions on how to mail the tax return.

Can you prepare my tax return if I'm a non-resident alien taxpayer?

No, non-resident alien tax returns require specialized training and the preparers in this program aren't certified to provide this service. We are not able to prepare Form 1040-NR.

Who will be preparing my tax return?

Students from Gies College of Business’ highly ranked accounting program will work with you to prepare your tax return. Our graduate accounting students, who are especially interested in tax, will be overseeing the program. They have tax-related work/intern experience and/or have demonstrated excellent technical knowledge of tax. They have also been highly recommended by their instructors and have demonstrated exceptional leadership abilities. Guiding the program this year is Mandi Alt, an instructor of accounting who brings 20 years of tax experience to the College.